Sales tax is levied on the sale of movable goods. In India the nature of income tax is.

Types Of Taxes Upsc Taxes In India Upsc Types Of Taxes In India Upsc Taxes In India

In the course of import into or export from India.

. The central government state governments and local municipal bodies. However any expense over Rs1600 per month is taxable. However one should be cautious before choosing a tax return form to file.

Greater Importance to Sate Government in Federal Fiscal System 6. Resident ROR Resident but Not Ordinarily Resident RNOR Non Resident NR 1. Domestic company Section 222A.

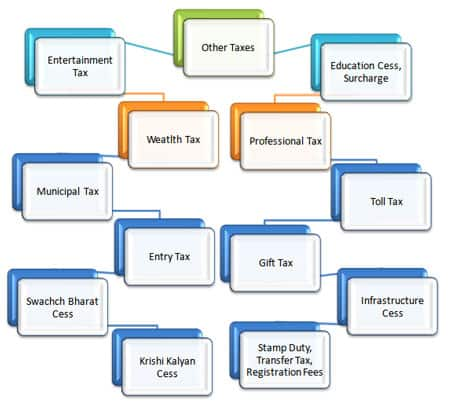

Indian company Section 226. The new indirect tax regime under the Goods and Services Tax GST which was rolled out on 1 July 2017 had. Goods and Services TaxGST came into effect on 1st July 2017 by amending the Constitution of IndiaIt is the One hundred and first amendment introduced by the Government of India.

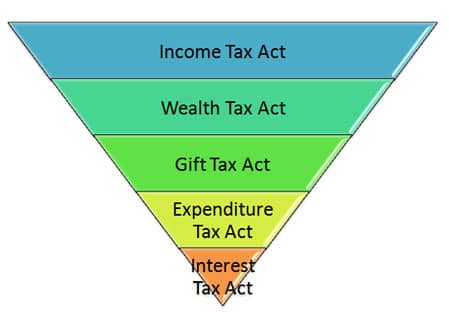

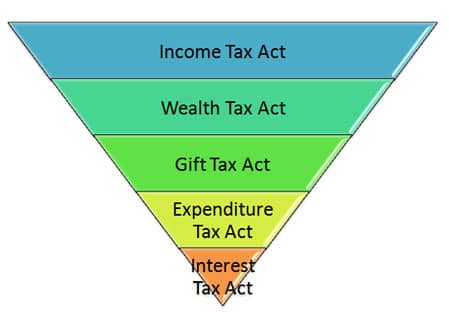

The service tax is collected by the Government of India and deposited with them. Income tax return is a form that allows you to file your taxes with the Income Tax Department. The most important direct tax from the point of view of revenue is personal income tax and corporation tax.

There are different types of income tax return forms depending on the taxpayers category and income type. The amount given by the employer for the treatment of the employee or hisher family. What are the different types of taxes in India.

Tax structure in India is a three tier federal structure. Tax Structure in India Explained. GST was hailed as a significant tax reform of Independent India that will help streamline the taxation process and reshaping Indias 24 trillion economiesThe primary objective was to.

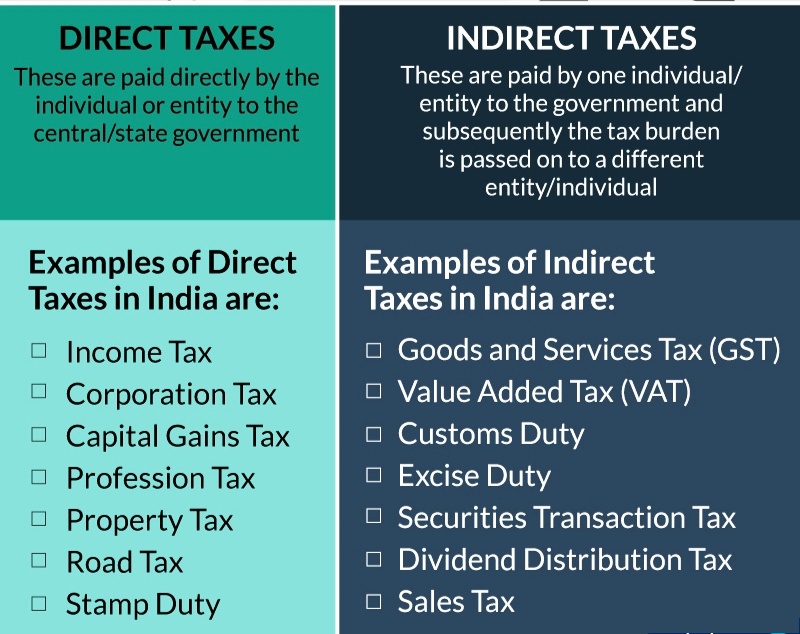

Typically the tax structure includes Direct tax and Indirect taxes. GST Goods and Service Tax Service tax sales tax octroi customs duty value-added tax and excise duty customs duty are some of the top examples. We will have a look at the different types of indirect tax in India.

The Scientific Division of Tax Powers. There are the following categories which classified the residential status of an individual. However only the following forms are to be taken into consideration by individuals when filing returns as per the Central Board of Direct Taxes in India.

If heshe stay in. The legal framework requires every individual and business to file income tax for each financial year. The direct tax includes income tax gift tax capital gain tax etc while indirect tax includes value-added tax service tax Good and Service taxm customs duty etc.

When it comes to taxes there are two types of taxes in India - Direct and Indirect tax. A Company in which the Public are substantially interested Section 218. As per section 217 Company means.

Another type of income tax in India is capital gains tax. Resident and Ordinarily Resident ROR Under Section 6 1 of the Income Tax Act an Individual is said to be resident in India if he fulfils the condition. Different types of taxes.

When any product or good is manufactured by a company in India then the tax levied on those goods is called the Excise Duty. Narrow Base and Others. Incidence of Taxation 7.

The Central Government of India imposes taxes such as customs duty central excise duty income tax and service tax. Apart from these types of taxation there are other taxes or cess levied by the government for specific purposes which are Krishi Kalyan Cess Swachh Bharat Cess and. In this case the Incidence and impact of taxes will fall on two different persons.

GST is a multi-stage location-based tax which is charged on each stage of the supply chain from the purchase of raw material till the. A direct tax can be defined as a tax that is paid directly by an individual or organization to the imposing entity generally government. Taxes in India.

Insufficient Tax Revenue 5. Medical Bills Reimbursement Allowance. A direct tax cannot be shifted to another individual or entity.

Larger share of Indirect Taxes 4. India has two types of taxes namely Direct Tax and Indirect Tax. This tax is levied by an entity in return for the service provided by them.

The core difference between both the taxes lies in their implementation. Income tax is levied on the income of individuals Hindu undivided families unregistered firms and other association of people. Outside a state or.

Tax is a mandatory liability for every citizen of the country. VAT Value Added Tax Value-added tax or VAT is an indirect tax which is imposed on goods and services at each stage of production starting from raw materials to the final product. Progressiveness in Tax Structure 8.

The amount offered to the employees for travelling from home to office and vice versa. Types of Companies under Income Tax Act. Types of the taxation system in India.

ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 and ITR 7. There are two types of tax in india ie. It is a tax which is imposed on any income that is derived from the sale of assets or investments.

The individual or organization upon which the tax is levied is responsible for the fulfillment of the tax payment. This includes property cars machinery businesses art bonds and shares. The following income tax return forms are applicable only for.

Tax System in India. In most cases the tax return is a worksheet with predefined parameters which helps calculate your income tax liability based on your income. The types of taxation system can be stated below.

It is levied on the value additions at different stages of production. In India Taxes are levied on income and wealth. India being a federation there is the existence of a multi-level finance system.

Central Sales Tax is payable on the sale of all goods by a dealer in the course of inter- state trade or commerce. Foreign company Section 223A. There are Four GST types namely Integrated Goods and Services Tax IGST State Goods and Services Tax SGST Central Goods and Services Tax CGST and Union Territory Goods and Services Tax UTGST.

The taxation rate under each of them is different. Sales Tax was charged on sale of Goods under the Sale Of Goods Act1930.

Tax Types Of Tax Direct Indirect Taxation In India

Indian Tax System Taxation Structure In India Current Policies Explainedaegon Life Blog Read All About Insurance Investing

0 Comments